RESERVE TICKETS TODAY - SPOTS ARE LIMITED

LIVE BOOTCAMP: Discover The Secrets To Paying $0 In Taxes In Real Estate For The Rest Of Your Life!

TAX STRATEGY BOOTCAMP 2024

What is Tax Strategy Bootcamp?

If you aren’t actively engaged in tax planning…

…this is what you’re doing to your money.

You’re sending the US government tens of thousands of dollars more than you have to, every single year.

$18,000, in fact.

After working with over 400 real estate investors 1-1 last year, that’s the average amount they were overpaying in taxes.

The top 1% know this, and that’s why they pay less in taxes than you do!

Here’s the thing though — you’re doing the same types of activities they are, just on a smaller scale.

They have businesses, so do you.

They have real estate, so do you.

So why is it you’re shelling out your hard-earned cash to Uncle Sam and they’re not?

That's where we come in...

If you aren’t actively engaged in tax planning…

…this is what you’re doing to your money.

You’re sending the US government tens of thousands of dollars more than you have to, every single year.

$18,000, in fact.

After working with over 400 real estate investors 1-1 last year, that’s the average amount they were overpaying in taxes.

The top 1% know this, and that’s why they pay less in taxes than you do!

Here’s the thing though — you’re doing the same types of activities they are, just on a smaller scale.

They have businesses, so do you.

They have real estate, so do you.

So why is it you’re shelling out your hard-earned cash to Uncle Sam and they’re not?

That's where we come in...

At Tax Strategy Bootcamp, you’ll be presented with 20+ workshops from myself and 2 other experts…

We’re the people those top one percenters go to for their investing & tax needs, and we’re going to peel back the curtain on:

- Self-directing your retirement account

- 1031 exchanges

- Entity structuring

- Real estate professional status

- The short-term rental loophole

And how the rich and wealthy use these strategies to their advantage

So join us live online for the most impactful 2 days of your 2024 tax year, so you can start playing the game just like the top 1%.

Does the IRS like this event?

Hell no.

See you there.

At Tax Strategy Bootcamp, you’ll be presented with 20+ workshops from myself and 2 other experts…

We’re the people those top one percenters go to for their investing & tax needs, and we’re going to peel back the curtain on:

- Self-directing your retirement account

- 1031 exchanges

- Entity structuring

- Real estate professional status

- The short-term rental loophole

And how the rich and wealthy use these strategies to their advantage

So join us live online for the most impactful 2 days of your 2024 tax year, so you can start playing the game just like the top 1%.

Does the IRS like this event?

Hell no.

See you there.

RYAN BAKKE, CPA

CHICAGO, IL

Who is Tax Strategy Bootcamp For?

Business Owners

Fix & Flippers

R.E. Syndication Investors

Real Estate Professionals

Anyone Who Wants To Pay Less Tax

Short-Term Rental Investors

Multi-Family Investors

Stock Market Investors

High Income Earners

REGISTER FOR TAX STRATEGY BOOTCAMP

Reserve Your Tickets

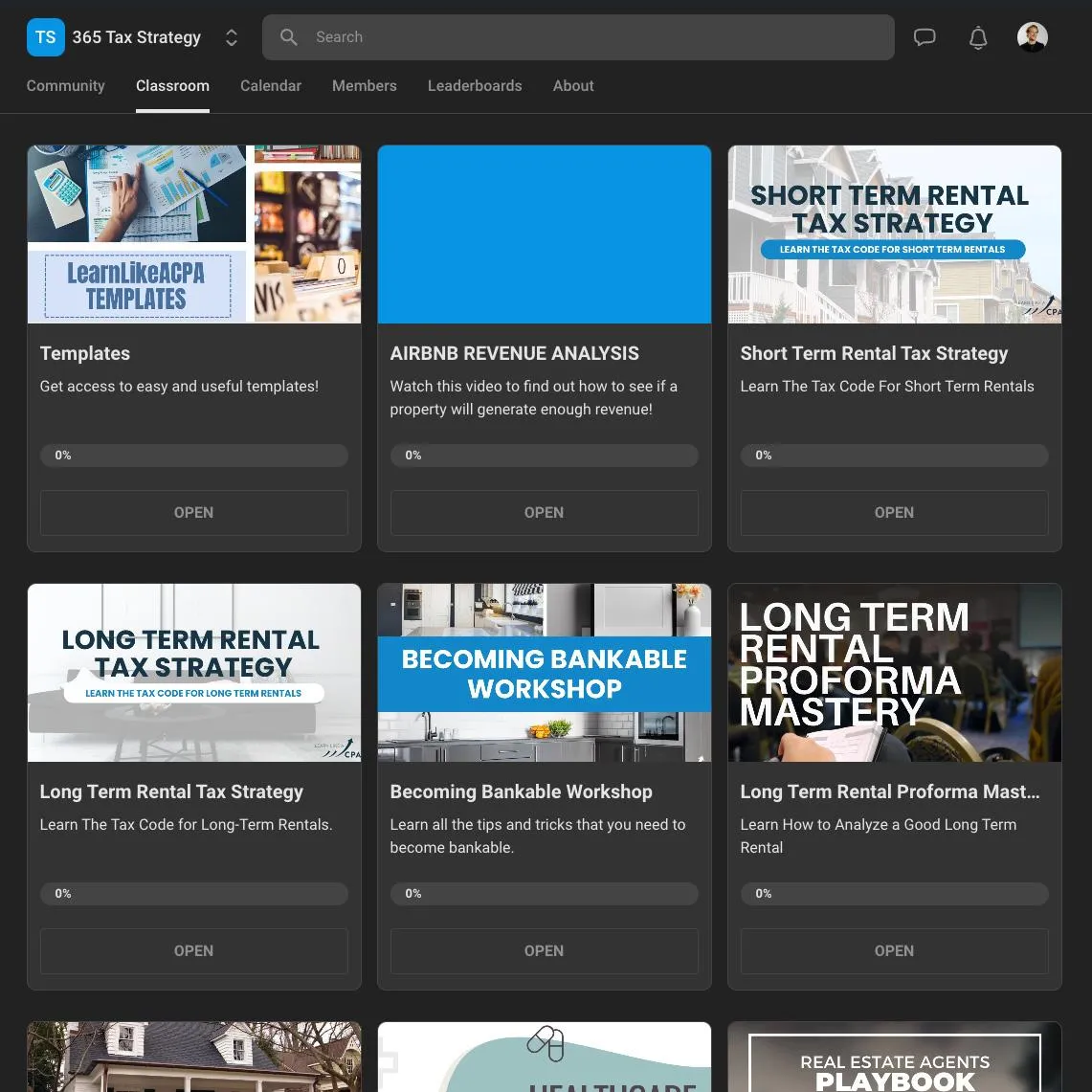

Tax Strategy Day 1

Workshops:

Tax Strategy vs Tax Preparation

Why Congress Writes the Tax Code

Foundational Investing for Real Estate Investors

Ryan's "Money-Flow Roadmap"

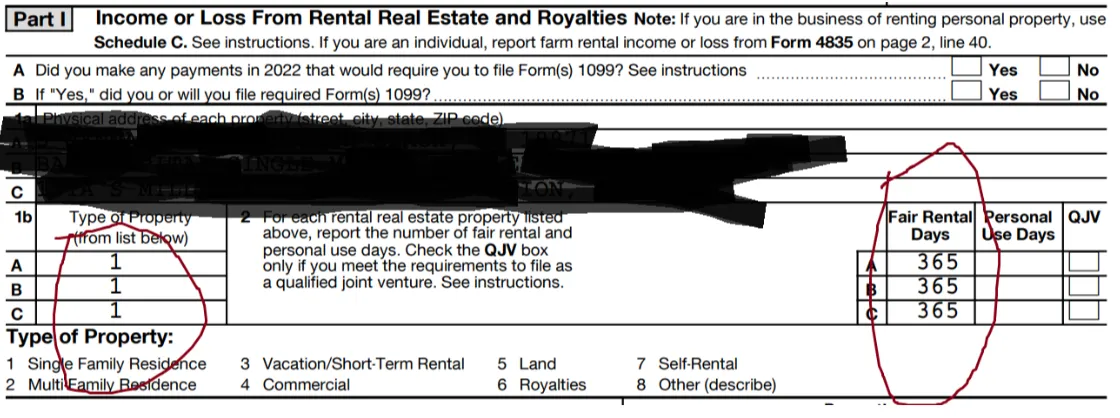

Tax Strategies for LTR Investors

Tax Strategies for STR Investors

Cost Segregation Studies

Exit Strategies to Defer Taxes

Tax Strategies for Real Estate Professionals

Self-Directing Your Retirement Accounts

Tax Strategy Day 2

Workshops:

Financial Freedom Roadmap

Tax Strategies for Syndications

Tax Strategies for MTR Investors

How to Convince a Seller to Seller Finance

Business Entity Structuring/Setup

Tax Strategies for Co-Hosts

Pass-Through Entity Tax Strategies

Tax Strategy for Flippers

Cash on Equity Audit

Protecting Your DTI

KEYNOTE SPEAKER

Ryan Bakke, CPA

Founder of Consulting MLS & LearnLikeaCPA

Investor, Entrepreneur, Speaker

Parker Borofsky

Mortgage Loan Officer, STR Investor

Mat Sorenson

Founder & CEO - Directed IRA & Directed Trust Company

REGISTER FOR TAX STRATEGY BOOTCAMP

Reserve Your Tickets

HERE’S EVERYTHING YOU’RE GOING TO GET WHEN

You Reserve Your Tax Strategy Bootcamp Ticket Now!

2-Day LIVE Online Event

Learn the strategies the top 1% use to create (and keep) their wealth.

Real estate, small business tax, strategies for high-income W2 employees.

20 Hours of Tax Strategy Content

Don't just hope the good stuff sticks - you'll get access to recordings of every session so you can go back and watch it all later!

PDFs + Templates for Implementing These Tax Strategies

Use our custom-made guides & templates to help you implement the strategies you've learned!

FIRST 50 TICKETS SOLD ONLY

Our team will ask questions about your current business/real estate portfolio and work with you to build a custom tax strategy for 2024 to save you 10s of thousands!

RESERVE YOUR TICKET

Reserve Your Ticket

Tax Strategy Bootcamp

20 World Class Live Workshops

Event Recordings

Custom Templates + Guides

BONUS: Free Tax Assessment

And More To Be Announced...

Frequently Asked Questions

Time/Date

May 3rd-4th 2024, 10a-5p Central Standard Time

Location

The workshops will be held fully online - Zoom link will be provided several days in advance!

Will the event be recorded?

Yes - Both days will be recorded and you will get the recordings shortly after the event is over!

What if I am interested in becoming a 1-1 client of Ryan's tax firm?

If you got tremendous value out of the Bootcamp, we will credit your payment towards our services!

What if I am a newer investor?

If you are a business owner or real estate investors you can benefit from tax strategy! So whether or not you own 1 or 10 properties there is a strategy that you can use to save on taxes!

I still need a CPA to file my tax returns!

The goal of this bootcamp is to allow you to be your own advocate for saving money on taxes. With your bootcamp ticket you will have plenty of informational material to take to your CPA/Accountant to explain strategies you implemented!

OR: If you are interested you can sign up with Ryan's firm to have your tax returns completed!

Will I be able to ask questions about my situation?

There will be plenty of time for Q+A during the bootcamp but also you will have an opportunity to ask questions during your personal tax assessment!